With interest in gold and battery metals rising, these six companies are boldly leaning into world-class opportunities

FEATURES & INTERVIEWS

IRVING RESOURCES

LI-FT POWER

RELEVANT GOLD

SNOWLINE GOLD

TANTALEX LITHIUM RESOURCES

WESTERN URANIUM & VANADIUM

JANUARY 2023

A special

interview with Anna Serin, CSE Director of Listings Development for Western Canada

List

The CSE’s streamlined regulatory model and unparalleled mining industry expertise allow mineral exploration companies to devote more time and capital to exploration, growth, and the creation of value. Discover why over 300 mining companies have chosen the Canadian Securities Exchange.

®

your mineral exploration

the CSE

secondary

via a cost-effective

company on

to access a liquid

market

platform.

Join the exchange built to support mineral exploration and growth

The mission of the CSE is to lower the cost of capital for public companies. And... enabling a company to easily raise capital at the lowest cost possible is probably the most significant contribution you can make as an exchange.”

for

Canada

“ COMPANIES

THE Market Size Capital Growth* * Since 2016 326 Listed Mining Companies $ 4.4Bn Market Cap of Mining Companies $2.6Bn Raised by Mining Companies 1.9K Financing Transactions Quick Stats Bunker Hill Mining Corp. BNKR Booth 124 Exploits Discovery Corp. NFLD Booth 212 Getchell Gold Corp. GTCH Booth 135 Green River Gold Corp. CCR Booth 635 Headwater Gold Inc. HWG Booth 205 Inflection Resources Ltd. AUCU Booth 205 Prismo Metals Inc. PRIZ Booth 612 Quebec Nickel Corp. QNI Booth 511 Sassy Gold Corp. SASY Booth 610 Sitka Gold Corp. SIG Booth 123 Snowline Gold Corp. SGD Booth 103 Western Uranium & Vanadium Corp. WUC Booth 330 EXHIBITING AT VRIC 2023 © 2023 CNSX Markets Inc. All Rights Reserved

Anna Serin, CSE Director of Listings Development

Western

and US

LISTED ON

A Focus on Issuer Service

20 Years in Business 1,000 + 71 Applications Processed New Mining Listings in 2022

The CSE collaborates with qualified third-party service providers to ensure you have a full suite of professionals at your disposal.

Access to Investors and Liquidity

• Full integration with professional trading and market information networks in Canada;

• Growing direct access to the exchange from the US and internationally through Interactive Brokers (for large issuers) and other institutional and retail-oriented brokers in the US and Europe.

Best-in-Class Fee Structure

Flat fee billed monthly, no annual fee, and no transaction fees

* Transaction fees include private placements, issuer bids, significant transactions, stock option plan reviews and amendments, take-over bids, exercise of convertible securities, corporate reorganizations, name changes, and more!

Connect With Us on Social Media

Anil Mall Director, Listed Company Services

For more information, please contact Anna Serin Director, Listings Development, Western Canada and US, Vancouver Branch Lead

T: (778) 580-5641

E: anil.mall@thecse.com

T: (778) 383-7704

M: (778) 828-2670

E: anna.serin@thecse.com

The CSE creates original, shareable content that investors who believe in your story can champion within their networks.

@CanadianExchange

thecse.com youtube.com/CSETV @CSE_News

/company/Canadian-Securities-Exchange

My position with the CSE allows me to integrate the knowledge, skills, and experience I have gained over the years and provide insight into the review and analysis of companies seeking a CSE listing that other exchanges may not be able to provide.”

“

Darcy Krohman, CSE Listing Manager and In-House Geologist

CSE Data Widely Available on These Platforms and More

Qualified CSE Issuers Trade on

FEE TYPE CSE TSXV TSX NEO Initial listing fee $15,000 - $20,000 $12,500 - $42,500 $20,000 - $200,000 $65,000 - $150,000 Annualized fees * $9,000 - $18,000 $5,200 - $90,000 $12,000 - $125,000 $15,000 - $100,000 Additional listing fees / supplemental listing $1,000 $2,500 $2,000 - $50,000 $10,000 - $150,000 Annual fee for supplemental listing $0 $0 $1,000 $750 Transaction fees * $0 $500 - $30,000 $0 $5,000

MINING

IN THIS ISSUE

ERIC ALLARD TANTALEX LITHIUM RESOURCES

ROB BERGMANN RELEVANT GOLD

SCOTT BERDAHL SNOWLINE GOLD

DR. QUINTON HENNIGH IRVING RESOURCES

GEORGE GLASIER WESTERN URANIUM & VANADIUM

4 | THE MINING ISSUE VRIC EDITION

FRANCIS MACDONALD LI-FT POWER

CONTENTS

TANTALEX LITHIUM RESOURCES | 6 Enjoying “best of all worlds” as two projects move toward production and initial drilling begins in large lithium corridor

SNOWLINE GOLD | 10 Strong grades over huge widths, yet this young company is just getting started

WESTERN URANIUM & VANADIUM | 14 Sights set on becoming a global leader in lowcost production of uranium and vanadium

RELEVANT GOLD | 18

Mapping out a new district with concepts 2.65 billion years in the making

IRVING RESOURCES | 22

As Japan opens back up, so do this successful explorer’s chances to find more high-grade gold and silver

LI-FT POWER | 26 Explorers will race to find lithium over the next decade, and Li-FT intends to lead the field

SPOTLIGHT ON ANNA SERIN | 30

CSE’s Director of Listings Development for Western Canada Anna Serin discusses her views on mining, markets and money in the current economic landscape

PUBLISHER

Sparx Publishing Group Inc.

sparxpg.com

For advertising rates and placements, please contact advertising@sparxpg.com

GROUP PUBLISHER

Hamish Khamisa

EDITOR-IN-CHIEF

James Black

EDITORS

Peter Murray

Libby Shabada

ART DIRECTOR

Elisabeth Choi

DESIGNER

Nicole Yeh

WRITERS

Giles Gwinnett

Angela Harmantas

Emily Jarvie

Andrew Kessel

Sean Mason

Peter Murray

Libby Shabada

FREE DIGITAL SUBSCRIPTION

Published by Sparx Publishing Group on behalf of the Canadian Securities Exchange. To receive your complimentary subscription, please visit go.thecse.com/Magazine and complete the contact form. To read more about the companies mentioned in this issue, visit blog.thecse.com or proactiveinvestors.com

Territory Acknowledgement:

The Canadian Securities Exchange acknowledges that our work takes place on traditional Indigenous territories.

® CANADIAN SECURITIES EXCHANGE MAGAZINE JANUARY 2023 | 5

TANTALEX LITHIUM RESOURCES

Enjoying “best of all worlds” as two projects move toward production and initial drilling begins in large lithium corridor

By Peter Murray

By Peter Murray

6 | THE MINING ISSUE VRIC EDITION

COMPANY INTERVIEW

Lithium is all the rage these days and for good reason, with the world going increasingly electric and viable sources of near-term lithium supply insu cient to meet projected demand. ere are plenty of lithium exploration projects on the go, yet grade, location and other factors suggest few will go into production anytime soon.

Tantalex Lithium Resources (CSE:TTX) is in the enviable position of having a tin and tantalum project readying for production in Q1 2023, a lithium project heading for production by 2025 and a huge lithium pegmatite exploration project soon to see its rst drilling ever. And expectations for the pegmatite project are high, sitting, as it does, near one of the world’s largest undeveloped hard rock lithium resources.

Tantalex President and Chief Executive O cer

Eric Allard is a veteran of mining in Africa and knows well the country in which his team operates, the Democratic Republic of the Congo, or DRC. In a recent interview with Canadian Securities Exchange Magazine, Allard discussed working in the DRC and outlined timelines to production and exploration for the company’s projects.

Tantalex has three projects that collectively involve lithium, tantalum and tin. All are in the DRC and two are progressing toward production. Tell us about your experience in the DRC and the various aspects of working there.

e DRC is a very mining-focused country, so the procedures, regulations and administration for mining companies are clear. ere is a mining code, a mining law and many mining companies operate there: Barrick is one, Glencore, Tra gura, ERG. ey focus mainly on copper and cobalt.

e DRC is a very favourable jurisdiction in that regard. e challenge is administration.

Because mines in the DRC are so rich, and mining represents such a large portion of the government’s annual revenue, they don’t so much see the difference between junior exploration companies

and producing companies. Moving forward as a publicly listed junior mining company can be challenging in the DRC because they are used to overseeing producing companies, and it is a different mindset.

Looked at another way, the DRC resources are so rich that they do not really look for investors either. Investors come to them.

We are fortunate because the DRC has stated that it is very interested in developing the electric vehicle battery metals space, lithium being one of the big elements. e biggest hard rock undeveloped resource was discovered a few years ago in the Manono area: 400 million tonnes at 1.65% Li2O, which is one of the most incredible LCT (lithium-cesium-tantalum) pegmatites ever. And that’s in the region where we are. Because we are operating tailings reclamation projects, our speed to market and ability to bring our projects to production is a big advantage. Seeing as we will likely be the rst lithium producer in the DRC, we are getting a lot of support from the government.

What about obtaining permits and finding skilled workers?

ere are no surprises as you go along. As long as you follow the procedures, the government will act upon them. As an example, we recently obtained a mining permit for our TiTan tin and tantalum project.

As far as human resources, Manono is a fairly remote area, but because the DRC is a mining country, there are a lot of very quali ed technicians, engineers and tradespeople available. at’s a big advantage compared to many other mining jurisdictions around the world that are su ering from serious labour shortages.

You just mentioned receiving permits for TiTan. What comes next?

We had to work with the government on getting a better road to reach the project, and that is almost complete. We will be pouring the concrete foundations in December. It is a $10 million investment, and we anticipate two to three months for

Allard President and Chief Executive

ALLARD “ Eric

Off icer Company Tantalex Lithium Resources Corporation CSE Symbol TTX Listing date October 22, 2013 Website tantalex.ca CANADIAN SECURITIES EXCHANGE MAGAZINE JANUARY 2023 | 7

WE ARE FORTUNATE BECAUSE THE DRC HAS STATED THAT IT IS VERY INTERESTED IN DEVELOPING THE ELECTRIC VEHICLE BATTERY METALS SPACE, LITHIUM BEING ONE OF THE BIG ELEMENTS.

construction. Commissioning is scheduled for March, and the start of production shortly therea er.

Can you walk us through TiTan’s economics and what this does for the company’s financials?

Production is planned to be 120 tonnes of tin concentrate per month and 20 tonnes of tantalum concentrate per month with a plant capacity throughput of 130 tonnes per hour.

On average, we are looking at about US$2.5 million to $3 million of revenue per month at today’s commodity prices, which would generate around $1 million to $1.5 million per month in net cash ow. e objective is to use it for the development of our other projects and also phase two and three of TiTan.

Talk to us now about the Manono Tailings project and the pegmatite corridor. Looking at maps of the projects, they seem to sit in a line.

ey do, and that is a big advantage because our team can be working

simultaneously on all three projects. e TiTan project is 40 kilometres southwest of the Manono Tailings project, so it’s all in close proximity.

Our agship is really the Manono Tailings project. It comes from an old tin mine that operated from 1913 to the 1980s. e mine focused on tin and tantalum and never exploited the lithium. We bought into the tailings licence in 2018, and there are 11 dumps and processed tailings terraces. We conducted a drone topographic survey of the entire concession area and con rmed 105 million tonnes of material on surface.

A year and a half ago we identi ed where we would start drilling, targeting

dumps with a higher presence of pegmatite, and we drilled on about half of the total dumps. We identi ed from our 13,000 metres of drilling a very interesting resource in the southwest portion.

We released the maiden resource for the Manono Tailings project on December 15, with 12.09 million tonnes at an average grade of 0.64% Li2O and a little under half already in the Measured and Indicated category. is allows us to proceed immediately with our phase one project to produce about 100,000 tonnes of spodumene concentrate per year at 6% Li2O (SC6) for an initial mine life of six to eight years.

With SC6 lithium concentrate foreseeably selling above US$4,000 per tonne for the next six to eight years and extremely low mining costs, you can see why we are so excited.

We are aiming to be in production by 2025.

And the pegmatite corridor is pure exploration at this point, is that correct?

Yes, our focus is to get the Manono Tailings project into production as soon as possible and take advantage of the supply shortage in the lithium space to generate substantial revenue for the company. We have already initiated a feasibility study and

8 | THE MINING ISSUE VRIC EDITION N

THE GOVERNMENT RELIES ON US TO HELP NGOS AND LOCAL POPULATIONS, AND BY US DOING SO, IT BRINGS EVERYONE CLOSER.

ALLARD “

environmental and social impact studies, and we are targeting the completion of the feasibility study by June 2023. A PEA (Preliminary Economic Assessment) will likely be issued in March.

e pegmatite corridor is the blue sky potential. It is a 25 kilometre corridor immediately adjacent and down strike to the 400 million tonne 1.65% Li2O hard rock resource I mentioned earlier. All geology indicates the pegmatites that formed the historical mine extend to the southwest onto our properties. ere are showings on surface of the pegmatites, but the corridor on our properties has never been drilled. We actually just started drilling there.

Let’s look beyond just mining for a moment. Tantalex supports community efforts in the DRC. What can you tell us about these and your motivation for being involved?

It’s a win-win. We are in partnership with the government with these e orts. e government relies on us to help NGOs

and local populations, and by us doing so, it brings everyone closer.

It’s a case of becoming a citizen of the country. We are not there just to prove up a resource. e ultimate goal is sustainability. And to have a sustainable operation when we plan to be in the DRC for the long term, we have to work with the community and help people as much as we can, and they will help us in return.

at’s what we are doing right now, and it is wonderful to see.

is latest medical campaign that we’ve supported, involving an NGO called Upright Africa, is just fantastic. It involved medical teams coming in and providing health care. Founder John Woods is a retired US doctor and has been in and out of Africa for the past 10 years, in war zones and lots of situations.

e Manono area was a thriving mining community for 80 years, and when the mine stopped so did everything else. Manono was forgotten by the rest of the world, but because there is more mining now, there is more hope. Doctors came

in, and they were able to inaugurate a new hospital and get operations going.

To see this happening not only helps people who are ill but gives hope to others. at’s what they need – they need to feel that somebody is there to help them out. e mortality rate for children under 12 is close to 40%. And they are dying from things that don’t make sense in 2023.

You are based in Canada, but the projects require a lot of expertise on the ground, and I see you had metallurgical work done in South Africa. Talk to us about operating advanced projects overseas.

I’ve spent most of my career on the ground, and our team is also very experienced in Africa. Most of the members of our board have worked or are still working in Africa. We have a team of about 100 in the DRC, so we have surrounded ourselves with experienced managers, operators and workers. For us, it is nothing new. It is just our normal area of work. It is very remote, and there are always the challenges of Africa, but it is our experience that enables us to operate there e ectively.

Is there anything we have missed?

To summarize, we are a company which is a near-term cash ow producer for three extremely strategic commodities: lithium, tin and tantalum, and also one with blue sky potential for much more discovery on our additional 1,200 square kilometres of exploration concessions around Manono. I think we have great assets and great people, and the timing could not be better for us. It is the best of all worlds.

ABOUT THE AUTHOR

CANADIAN SECURITIES EXCHANGE MAGAZINE JANUARY 2023 | 9

Peter Murray oversees a national editorial and broadcasting team as President of Proactive Canada. He spent several years managing the English news desk at Nikkei’s head of ce in Tokyo and has worked with research teams at Asian and European investment banks. Peter is based in Vancouver.

Scott Berdahl Chief Executive Off icer

Company

Snowline Gold Corp.

CSE Symbol

SGD

Listing date

April 25, 2019

Website snowlinegold.com

COMPANY INTERVIEW 10 | THE MINING ISSUE VRIC EDITION

SNOWLINE GOLD

Strong grades over huge widths, yet this young company is just getting started

By Giles Gwinnett

Snowline Gold (CSE:SGD) only came into being as a publicly listed company in March 2021, but this Yukon-focused gold explorer has actually been some 30 years in the making.

Father and son prospecting team Ron and Scott Berdahl, the latter now Snowline’s Chief Executive O cer, spent years steadily building a land package in the territory’s underexplored Selwyn Basin. e company now holds 17 projects over 254,000 hectares. Nearby deposits include Kinross Gold’s Fort Knox Mine and Victoria Gold’s Eagle Mine.

Exploration-wise, Snowline, which counts Eric Sprott and Keith Neumeyer as investors, is o to a ying start. It has completed initial drill programs at three never-before-drilled targets and hit visible gold at every one. It recently announced drill results from the Valley Zone target at its 11,000 hectare Rogue project, interpreted to host reduced intrusion-related gold systems (RIRGS), where one hole returned 2.55 grams per ton gold over 318.8 metres from surface.

Elsewhere, the company’s Einarson project spans nearly 85,000 hectares and boasts both orogenic and Carlin-style gold targets.

Canadian Securities Exchange Magazine spoke with Scott Berdahl in December about the company’s accomplishments to date and its plans for 2023.

What are the advantages of discovering a gold district as a junior explorer? Why is it so exciting?

It gives you the opportunity to continue to drive value creation through discovery. A lot of companies might have a single asset, whether it’s a green eld or brown eld target that they are able to nd something new in, bring online or make a discovery and bring value to the table that way. But with a new district, there’s just so much upside.

People talk about the Lassonde Curve, where discovery is an important value creation phase and then it peters out into that orphan period while development decisions are made and permits awaited. In the case of a district, you have the potential to just keep going out and making discoveries. And you never know – the rst target you nd is not necessarily the best in the district. So, we are trying to balance the discoveries we are making with exploration elsewhere to not lose sight of the forest for any single tree.

Obviously, the Valley target at your Rogue project is shaping up to be very exciting. Can you explain why it’s so compelling?

Valley is particularly exciting because it’s so high grade. It’s called a reduced intrusion-related gold system, which is traditionally a bulk tonnage target. What

CANADIAN SECURITIES EXCHANGE MAGAZINE JANUARY 2023 | 11

makes these systems work isn’t grade, it’s their scale, consistency and metallurgy. You have systems like the Fort Knox Gold Mine in Alaska, where they are currently mining material that is 0.3 grams per ton with a 0.1 gram per ton cut-o . at is in a gold-only system. And we’re hitting large intervals of grades that are multiples to even an order of magnitude above that.

What are your next steps for Valley?

Well, rst is getting the rest of the assays in. We’re still waiting for 75% of the assays from Valley and 80% of the assays from drilling last season. We also drilled a similar target to the east called Gracie but, unlike Valley, that intrusion doesn’t come to surface, so we’re still looking to nd it. Once we get those in, we will have a better handle on how we want to approach the target next season.

We would like to increase the density of drilling at Valley to get a better feel for the grade distribution, basically to demonstrate continuity and improve our grasp of a potential resource. And as I mentioned, moving forward, there is a lot of potential in the surrounding area. We have a cluster of these intrusions on our Rogue project, and we recently acquired another cluster of intrusions of a similar age and provenance to the south on our Golden Oly project.

Can you explain what the difference is between a reduced intrusion-related gold system like at Valley and the orogenic systems you have at Einarson?

ere are a few di erences. e key one is geometry. When you have a RIRGS, the mineralization is not in one vein, it’s thousands of veins. In an orogenic system, you generally have one or several veins, and it might blow up to a wide, high-grade zone in certain areas and pinch out, but they can be quite inconsistent.

Don’t get me wrong, orogenics can hold fantastic resources, but they require

a lot more drilling to gure out what’s there. And if you hit in one place and you hit 100 metres away, there’s much less guarantee that there’s anything between those two sites that’s of substance.

In a RIRGS, you are also looking at veins, but thousands of them form basically a big cloud of mineralization, and they’re much thinner veins than you would see in an orogenic system. ey are o en around a centimetre thick, but they stretch for hundreds of metres to a kilometre in length and tens of metres to hundreds of metres wide, down to depths of a kilometre. RIRGS are also more attractive from an exploration standpoint. In terms of being a cash-starved junior and trying to make your metres count, you don’t have to drill with the same density as on an orogenic system to gure out what’s there.

You have said that Valley hosts similar geology to Victoria Gold’s Eagle Mine. What are the similarities and the differences?

ey are both intrusion-hosted gold systems with mineralization hosted in arrays of sheeted quartz veins. e mineralogy looks to be very similar. e primary difference between this and Eagle, as well as Fort Knox and other reduced intrusion-related gold systems, is the vein densities.

Commonly, in a place like Eagle or Fort Knox, if you have three to ve veins in a metre, you’re looking at good-looking

12 | THE MINING ISSUE VRIC EDITION

rock and good potential ore. At Valley, we’re seeing big zones of 10, 20, even 30-plus veins per metre. And that really makes a di erence when it comes to grade.

Of course, the veins themselves have to be mineralized, but getting that high density is really a strong driver for grade. At Valley, it seems like it’s a more active geological system. It’s a polyphase intrusion, so there was a lot going on, and it had a complex life and emplaced itself in the crust and cooled and that led to multiple pulses of mineralization. It’s the same type of deposit formed multiple times on the same spot in very short order.

What news flow can investors expect from the company over the next year or so?

I think there will be two big phases. e rst is getting the rest of the 2022 drill results in. We’re still waiting for the vast majority of our samples from 2022, including from Valley. I think that system will really start to take shape.

At the same time, we’re running metallurgical tests to get a better sense of how this mineralization will behave

when it comes time to extract gold. I think that will be a big potential value add, but of course we don’t know for sure until we get those tests back. But looking over the fence at similar kinds of systems, we have a lot of con dence.

e second phase of news will really come as we gear up and get into next season and continue to build on the success we’ve had. Hopefully, we will build out the Valley discovery and de-risk it further, as well as making additional discoveries on the many targets we now have. We have several dozen targets in our portfolio and a lot out there le to explore.

What’s the aim here? Are you going to sell the project or partner it? Are you going to try and build a mine?

e aim is ultimately to create value for both shareholders and the Yukon. We will take it as far as we have to, and if an attractive o er were to come in, obviously, we would consider it. If it doesn’t, and we continue to like what we see, we will continue to progress the project.

Building a mine sounds a little daunting, and it probably should. I

HOPEFULLY, WE WILL BUILD OUT THE VALLEY DISCOVERY AND DERISK IT FURTHER, AS WELL AS MAKING ADDITIONAL DISCOVERIES ON THE MANY TARGETS WE NOW HAVE. WE HAVE SEVERAL DOZEN TARGETS IN OUR PORTFOLIO AND A LOT OUT THERE LEFT TO EXPLORE. BERDAHL

think a lot of explorers have been burned trying their hands as developers but that doesn’t mean that we couldn’t restructure, rebuild a team or refocus at least part of the company on development while still not giving up on that exploration upside and the strong exploration team we have. I think there are multiple paths to drive value creation here. We will have to see what comes in the next few months and years.

Giles Gwinnett is a UK-based journalist who has been with Proactive for 10 years, and on its North American coverage team for ve. Prior to that he worked for several years at regional newspapers and for a news agency. Giles has written about a wide variety of business and other topics in his career, including the arts, crime and politics.

“ ABOUT THE AUTHOR

CANADIAN SECURITIES EXCHANGE MAGAZINE JANUARY 2023 | 13

WESTERN URANIUM & VANADIUM

Sights set on becoming a global leader in low-cost production of uranium and vanadium

By Sean Mason

Nuclear energy is positioned as a key component in the worldwide push to reduce carbon emissions. Nuclear reactors, a er all, generate power through heat released by ssion, which is used to create steam that spins a turbine to generate electricity without the harmful emissions associated with fossil fuels.

Uranium demand to fuel the world’s nuclear reactors is expected to rise to 79,400 metric tonnes of elemental uranium (MTU) by 2030, up from 62,500 MTU in 2021, with that number anticipated to climb to 112,300 MTU in 2040, according to a report by the World Nuclear Association.

Colorado-based Western Uranium & Vanadium (CSE:WUC) is a mining company focused on low-cost, near-term production of uranium and vanadium in the western United States. e company has a large production-ready, permitted and developed high-grade uranium and vanadium resource, which includes the Sunday Mine Complex developed by Union Carbide for almost US$50 million in the 1970s.

Chief Executive O cer George Glasier has a record of uranium mining success, having founded Energy Fuels, which is currently the largest uranium and vanadium resource holder in the US. On a recent call with Canadian Securities Exchange Magazine, Glasier discussed Western Uranium & Vanadium’s goal of becoming a low-cost uranium and vanadium producer, as well as why now could be a good time for investors to consider companies in the space.

Tell us about why you were motivated to form Western Uranium & Vanadium.

e motivation was the expected increase in the price of uranium and vanadium. I’ve been in that industry for years, having previously formed Energy Fuels, and I was also involved with the original company called Energy Fuels Nuclear back in the late 1970s and early 1980s, which became the largest uranium producer in the US.

When the industry was in bad shape and commodity prices were low, there was no reason to consider

COMPANY INTERVIEW 14 | THE MINING ISSUE VRIC EDITION

being in the uranium mining business. But as prices looked like they were going to rebound, we formed Western Uranium & Vanadium in 2014 to buy a key asset package from Energy Fuels.

So, my motivation was to take advantage of these incredible properties that we could acquire at a reasonable price for the expected uranium boom and get back into the uranium business with a pro table company.

Why might now be a good time for investors to consider uranium and vanadium stocks?

Well, because I don't think we've reached the peak, and the CEO of Bannerman Energy just said we need an $80 per pound uranium price around the world to produce the supplies needed to keep reactors operating.

Let’s say we're at a spot price of around $50 and maybe we're at a term price of $60. But to incentivize additional production, we need

an $80 uranium price. And at $80 there are a number of companies that stand to make quite a bit of money, including the explorers over the longer term. If an investor wants to get into a commodity, there's probably not a better commodity right now than uranium with the expected price increase.

Our company is a dual producer of uranium and vanadium, which is very unusual, as most uranium companies don't have vanadium. And vanadium, which had been used primarily as an alloy for steel, is now being used in vanadium redox ow batteries for stationary energy storage. is should provide a real boost to the demand for vanadium around the world and ultimately increase the value of vanadium.

I think that investing in a company that has both uranium and vanadium as commodities could be a double win, as both seem set to increase in value over the next ve years.

George Glasier Chief Executive Off icer Company

Western

& Vanadium Corp. CSE Symbol WUC Listing date November 24, 2014 Website western-uranium.com

Uranium

CANADIAN SECURITIES EXCHANGE MAGAZINE JANUARY 2023 | 15

Your company has stated that production will be restarting soon at the Sunday Mine Complex. What is required to begin operations there?

e process has begun. In fact, we just hired two new people this week, and we're hiring the rest of the crew who will be on board a er the rst of the year. And we've already got all the equipment we need for the rst stages of production. e mine was in production as recently as 2022, but the mining contractor wanted to shut down for various reasons, mostly due to his health. So, we did that and began buying mining equipment, starting with his. We thus have very little to do to get started — just really hire some more employees. e mine is fully permitted, developed and ready to go, and we will be back at that mine in January with our production crews.

In May, you announced revenue from a uranium concentrate supply agreement. Are there any other near-term revenue opportunities for the company?

We own oil and gas royalties that generate revenue of up to $50,000 a month, and the operator just drilled additional wells to bring into production. It’s a revenue stream that we have, and it's kind of unique for a uranium and vanadium company. And while the revenue it generates is not insigni cant, it won’t be a value creator for our company.

Do you plan on adding more oil and gas royalties?

No, this just happens to be a uranium property we acquired with additional minerals. We're not an oil and gas company, and we're not a royalty company. But we had the assets, so we took advantage of that by leasing it to an oil company, and they drilled these wells in the oil and gas elds of northern Colorado.

We don't intend to acquire more oil and gas royalties. We’re a uranium and vanadium producer, and we do that well. at being said, we could go on collecting these royalties for another 20 or 30 years.

“ 16 | THE MINING ISSUE VRIC EDITION

I THINK THAT INVESTING IN A COMPANY THAT HAS BOTH URANIUM AND VANADIUM AS COMMODITIES COULD BE A DOUBLE WIN, AS BOTH SEEM SET TO INCREASE IN VALUE OVER THE NEXT FIVE YEARS. GLASIER

What do your shareholders have to look forward to in the next 12 months?

We recently came out with some big news that really sets the stage for everything else this year. A er many months of assessing locations, we found the perfect site for building the processing plant that will handle ore from the Sunday Mine Complex and ore from our other projects, as well as feed from other conventional miners.

So, it’s great as a team to have acquired land parcels in Utah for the facility, and now we’ll be going all out to get it into mill production as fast as reasonably possible.

Permitting is our focus right now, and we are targeting 2026 for initial mill production. At start-up, the plan is to produce 2 million pounds of uranium per year and 5 million to 6 million pounds of vanadium. A cobalt circuit will be designed and constructed if there is enough interest from nearby companies who have cobalt ore.

I’d also highlight that in addition to substantial production coming out of the Sunday Mine, we will be expanding extraction into each of the ve mines comprising the broader Sunday Complex. It’s reasonable to anticipate two or three crews working at the

complex by the end of 2023. We’ll be stockpiling ore there so that we’re ready to provide consistent feed to the processing facility.

Is there anything else that you want prospective investors to know about your company?

We believe this industry has a real future. We're a small company, we're well-sta ed with good people and we've got great resources. If you look at our resource base, it may not all be NI-43-101 compliant, but we carry over 50 million pounds of historical resources based upon limited drilling. And our resource base with high-grade uranium and vanadium is probably going to be some of the lowest-cost production in North America, if not the world.

WE BELIEVE THIS INDUSTRY HAS A REAL FUTURE. WE'RE A SMALL COMPANY, WE'RE WELL-STAFFED WITH GOOD PEOPLE AND WE'VE GOT GREAT RESOURCES.

“ ABOUT THE AUTHOR

GLASIER

CANADIAN SECURITIES EXCHANGE MAGAZINE JANUARY 2023 | 17

Sean Mason has been covering North American equity markets for more than 20 years, including for publications such as Investors Digest of Canada. He is a graduate of the University of Toronto and has successfully completed the Canadian Securities Course.

RELEVANT GOLD

Mapping out a new district with concepts

2.65 billion years in the making

By Angela Harmantas

COMPANY PROFILE 18 | THE MINING ISSUE VRIC EDITION

Relevant Gold (CSE:RGC) is a new company on the CSE with a bold idea.

Built by serial entrepreneurs with a track record of success in the exploration space, Relevant is casting “new eyes on old rocks,” as Chief Executive O cer Rob Bergmann likes to say.

And it has come up with a big hypothesis: shear-hosted gold mineralization throughout Wyoming is connected to the proli c Abitibi shear zone belts in Ontario and Québec, making the state the potential site of a new gold rush. e Abitibi is one of the world’s premier gold districts, with over 230 million ounces of gold produced over the last 100 years and more being uncovered throughout the belt.

Relevant Gold’s interpretation of geological records comes straight from science. Dr. Kevin Chamberlain is a researcher at the University of Wyoming and one of several technical advisors to the company. He has also authored publications on the tectonic reconstruction of the region and helped propel the structural thesis to the forefront, connecting the structure to the actual Superior Province, a crustal block stretching from Ontario and Québec to northern Minnesota, during its critical development window.

Relevant Gold’s other technical advisors include Dr. Tom Campbell, who spent his entire career working in orogenic shear-hosted gold systems, both at the Homestake Mine as well as in the Abitibi, and Dr. Dean Peterson, who did his PhD research on the Abitibi, speci cally looking at the gold produced in the Timmins, Kirkland Lake and Hemlo camps.

e technical team hypothesizes that the gold deposits of the Abitibi formed around 2.65 billion years ago across the Abitibi province, or craton, and the Wyoming province. e two cratons started to dri apart around 2.1 billion years ago to come to rest beneath what is now the Canadian provinces of Ontario and Québec. Half a billion years later, major tectonic dri ing occurred that moved those geologic provinces and plates apart to where they sit now.

Essentially, if the Wyoming craton was attached to the Abitibi, then the gold and the deformation happened in both provinces. Relevant Gold’s team of experts believes that its own reconnaissance is beginning to prove the model through extensive exploration in the state.

Bergmann told Canadian Securities Exchange Magazine that the team was “standing on the shoulders of giants” in connecting the dots to form its

CANADIAN SECURITIES EXCHANGE MAGAZINE JANUARY 2023 | 19

theory, building upon existing literature published by leading educators.

“We’re pioneering this idea from an economic level in today’s environment,” Bergmann explains. “ ere have been multiple papers published on the theory of these connections, but the science itself hasn't been around for that long. One of our key advantages is that it is a relatively young science. A lot of it came from modern technologies that allow scientists to age-date the rocks more accurately, connect those in time and do that full reconstruction.”

Wyoming is not exactly unknown in a mining context. In 2020, the state was rated as having the second-most friendly mining policies globally by the Fraser Institute, so projects face lower social and environmental risk. As the least populated state in the country, Wyoming was founded on resource development, and permitting is about as streamlined as it gets. But it is other resources – bentonite, coal, rare earths and uranium – that dominate the state’s mining matrix; gold, less so.

at said, Relevant Gold is one of a handful of companies zeroing in on Wyoming’s resources. Nasdaq-listed US Gold is looking to put its CK gold

project into development, and other companies are starting to ramp up exploration activities.

Relevant Gold, however, is at the forefront of pioneering the Abitibi comparisons, which gives them a lot of room for exploration. In Relevant Gold’s case, that would mean searching for an orogenic-style gold deposit similar to the massive Timmins, Canadian Malartic or Hemlo operations in the Abitibi.

“When we set out to build the portfolio, we took a look at the criteria needed for an Abitibi-like system, and we narrowed in on district-scale opportunities,” Bergmann says. “Each one of our ve properties that we’ve assembled is large enough to host a deposit of that scale, as well as the potential development footprint.”

Relevant assembled ve district-scale assets totalling over 40,000 acres of ground, including the current agships, Golden Bu alo and Lewiston. While both projects are at the earliest stages of development, Bergmann and the team see “a lot of catalysts” in the near and longer terms.

“As a geologist at heart, it is exciting because this stu has never been drilled, and the thesis is very new,” says Bergmann. “For example, we just completed our inaugural drill program at one of our projects, the Golden Bu alo project. We are the rst ones to ever see those rocks at the subsurface, which is pretty exciting.”

Golden Bu alo has “an abundance” of high-grade visible gold at surface, according to Bergmann. e focus of the inaugural drill program is to de ne the geology and the structural architecture in the subsurface. As Bergmann explains, in the Abitibi, it can take on average around 70 to 100 drill holes before making a discovery. Usually, companies going

20 | THE MINING ISSUE VRIC EDITION

Rob Bergmann Chief Executive Off icer Company

Relevant Gold Corp.

CSE Symbol

RGC

Listing date

August 11, 2022

Website relevantgoldcorp.com

into a drill program already have an abundance of knowledge of the subsurface. at’s where Relevant di ers.

“We went in and didn't have any of that knowledge, but we were still able to complete 26 holes and about 3,500 metres in the inaugural program,” says Bergmann. “Ultimately, our main goal is to de ne the subsurface geology and the architecture and understand if this is truly a big orogenic system, meaning do these shear zones extend at depth into the subsurface and along strike? Is there uid evolution related to that?”

From there, Relevant will start vectoring toward a gold deposit opportunity of scale. “We know that we've got a lot of gold at surface and that the system’s enriched, but we really need to con rm that the system is there at a scalable size,” Bergmann explains. “ at would really help position us to continue to go at Golden Bu alo and also help guide our drilling on Lewiston and our other high-value targets.”

All told, Relevant Gold has assembled a very knowledgeable board with a management group

and technical team that can carry out its plans e ciently and cost-e ectively, a fact Bergmann stresses is important in today's market.

“Investors are looking at the markets a little bit di erently, and rightfully so,” Bergmann says. “I'd like to think that at Relevant Gold, we are one of these juniors that is very well positioned in these current markets, which not a lot of folks can say. We're a very clean company with a clean share structure and a long runway of opportunities and targets. We've been able to sustain some value in the marketplace, and with strong support and shareholders that are with us for the long term, we really believe in the team and our ability to create value.”

“

WE'RE A VERY CLEAN COMPANY WITH A CLEAN SHARE STRUCTURE AND A LONG RUNWAY OF OPPORTUNITIES AND TARGETS. BERGMANN

ABOUT THE AUTHOR CANADIAN SECURITIES EXCHANGE MAGAZINE JANUARY 2023 | 21

Angela Harmantas is a Senior Financial Journalist with Proactive. She has 10 years’ experience covering the equity markets in North America, with a particular focus on junior resource stocks. Angela has reported from multiple countries, including Canada, the US, Australia, Brazil, Ghana and South Africa. Prior to joining Proactive, she worked in investor relations and led the foreign direct investment program in Canada for the Swedish government. Angela currently resides in Toronto.

IRVING RESOURCES

As Japan opens back up, so do this successful explorer’s chances to find more high-grade gold and silver

By Emily Jarvie

By Emily Jarvie

COMPANY PROFILE 22 | THE MINING ISSUE VRIC EDITION

Aso er Japanese economy, technological advancements, more favourable government policies and a shi in the local attitude toward mining mean it has never been a better time to explore and develop in Japan, according to Vancouver-based junior gold explorer Irving Resources (CSE:IRV).

Formed as a spin-out in a 2015 plan of arrangement between Gold Canyon Resources and First Mining Finance, Irving’s Co-Founders, Akiko Levinson and Dr. Quinton Hennigh, created the company with a focus on exploration in Japan.

Levinson, who is also Irving’s President and Chief Executive O cer, has more than 25 years of experience in the junior mining industry, previously serving as President of Gold Canyon Resources.

Hennigh, an economic geologist with more than 25 years of exploration experience with major gold mining rms, is Irving’s Technical Advisor.

ey have attracted notable shareholders to Irving, including Newmont, the company’s largest investor, holding a stake of just under 20%, and Sumitomo Corporation, which holds about 5%. rough subsidiary Irving Resources Japan GK, Irving has been operating in Japan for six years with a growing portfolio of 100% owned projects located across the islands.

According to Levinson, who is Japanese, the company is not seen as foreign.

“Most of our team members are Japanese or foreigners who reside in Japan,” Levinson says, adding that having an understanding of the Japanese language and culture gives Irving an advantage while operating in the country.

Irving’s focus is on high-silica, high-grade epithermal gold and silver veins, with such ore suitable for smelter ux in one of the many existing base metal smelters in Japan. Precious metals such as gold and silver are recovered during the smelting and re ning process.

Hennigh told Canadian Securities Exchange Magazine that this is a simple, cost-e ective and environmentally friendly way to produce gold and silver, as it does not require signi cant capital investment and generates very little surface waste.

“You simply identify deposits that have a high silica content along with appreciable gold and silver that are suited for smelter ux,” says Hennigh. “It’s an absolutely elegant model for developing gold mines.”

Irving Resources Inc. CSE Symbol IRV Listing date December 23, 2015 Website irvresources.com CANADIAN SECURITIES EXCHANGE MAGAZINE JANUARY 2023 | 23

Dr. Quinton Hennigh Director and Technical Advisor Company

Irving’s agship project, Omu, is located in an epithermal vein district on Japan’s northern island of Hokkaido. Exploration to date has focused on three targets: Omui, Hokuryu and Omu Sinter.

“We have completed drilling on all of those targets, in some cases multiple drill programs, and we think we have substantial discoveries of high-grade gold and silver veins,” Hennigh notes. “We’re seeing potentially economic deposits at all three targets.”

Another main project is Yamagano, which encompasses the past-producing Yamagano Gold Mine, where mining dates back about 400 years. e site has never been explored using modern methods.

Acquired in September 2020, Yamagano is located 11 kilometres southwest of Sumitomo Metal Mining’s Hishikari Gold Mine, which Hennigh points out has produced about 8 million ounces of gold and is one of the highest grade gold mines in the world. “We think Yamagano is a very close analog that could have similar potential,” he explains.

Hennigh also highlighted a group of tenements that the company has recently applied for on the Noto Peninsula. Totalling 337 square kilometres with four target areas, the tenements have displayed strong stream sediment gold, silver, arsenic, antimony, mercury and gold anomalism.

“We have identi ed several areas where there are very clear gold anomalies that have no historical record,” he says. “In other words, there could be substantial epithermal vein occurrences that are yet to be recognized.”

In uencing Hennigh’s and Levinson’s decision to focus their exploration e orts on Japan was a perfect alignment of factors.

A so ening Japanese economy has made exploration and mining cheaper in the country, just as the sensitivity around mining has diminished with past problem projects now cleaned up and remediated. Meanwhile, revamped mining laws have made it more feasible for exploration in Japan.

“With Japan’s demographic shi , its aging population, many of these small towns in rural areas would fade away, so they welcome that we bring economic life to their town,” Hennigh says.

On the geology side, Hennigh highlights advancements in the understanding of epithermal gold systems in recent years as another factor. “ at bodes well for discovering new blind deposits that were not well recognized previously.”

For Irving, working in Japan is all about building relationships and trust. e company has made an e ort to build relationships with every stakeholder it works with, from local farmers to major players in the mining sector.

WITH JAPAN’S DEMOGRAPHIC SHIFT, ITS AGING POPULATION, MANY OF THESE SMALL TOWNS IN RURAL AREAS WOULD FADE AWAY, SO THEY WELCOME THAT WE BRING ECONOMIC LIFE TO THEIR TOWN.

HENNIGH 24 | THE MINING ISSUE VRIC EDITION

“

“Akiko has gotten to know and sat down and had tea with many of the farmers in the area,” Hennigh explains. “She knows the mayor of the area where our agship Omu project is quite well. We see these as important relationships to build to make everyone comfortable about the changes and opportunities within mining.”

At a higher level, the company has built strong relationships with Japan’s old mining houses and with government agencies such as the Japan Organization for Metals and Energy Security (JOGMEC), an organization administered by the Ministry of Economy, Trade and Industry of Japan responsible for the stable supply of various resources.

“

ese groups that we’ve connected with are part of the overall system that is going to be required to make new mines happen in Japan,” Hennigh says.

In 2023, Irving plans to accelerate exploration across its portfolio by adding a third drill rig a er being handcu ed by pandemic-related travel and other restrictions for the past three years.

It is building up its roster of sta to operate the drills, including expats from foreign countries and Japanese drillers.

According to Hennigh, Irving expects to drill three promising targets at its agship Omu project and commence testing of a new target at the project, Maruyama, which has returned silica-rich surface samples with good values of gold and silver.

At its Yamagano project, Irving has been carrying out geophysical work in preparation for a drill program to commence in the latter half of 2023.

Hennigh says the addition of a third drill rig is a major milestone for the company because it will allow Irving to carry out two concurrent drill programs: one in Hokkaido at its Omu project and one in Kyushu at its Yamagano project.

“By the end of 2023, I expect to operate three drills on a routine basis in Japan once we’ve got all our people in place,” Hennigh concludes. “ is is a big step that dramatically accelerates our drilling and our ability to test targets.”

THESE GROUPS THAT WE’VE CONNECTED WITH ARE PART OF THE OVERALL SYSTEM THAT IS GOING TO BE REQUIRED TO MAKE NEW MINES HAPPEN IN JAPAN.

“ ABOUT THE AUTHOR

HENNIGH

CANADIAN SECURITIES EXCHANGE MAGAZINE JANUARY 2023 | 25

Emily Jarvie began her career as a political journalist in Australia. After she relocated to Canada, she worked as a psychedelics journalist, reporting on business, legal and scienti c developments before joining Proactive in 2022. Emily has worked as a reporter in Australia, Europe and Canada.

26 | THE MINING ISSUE VRIC EDITION

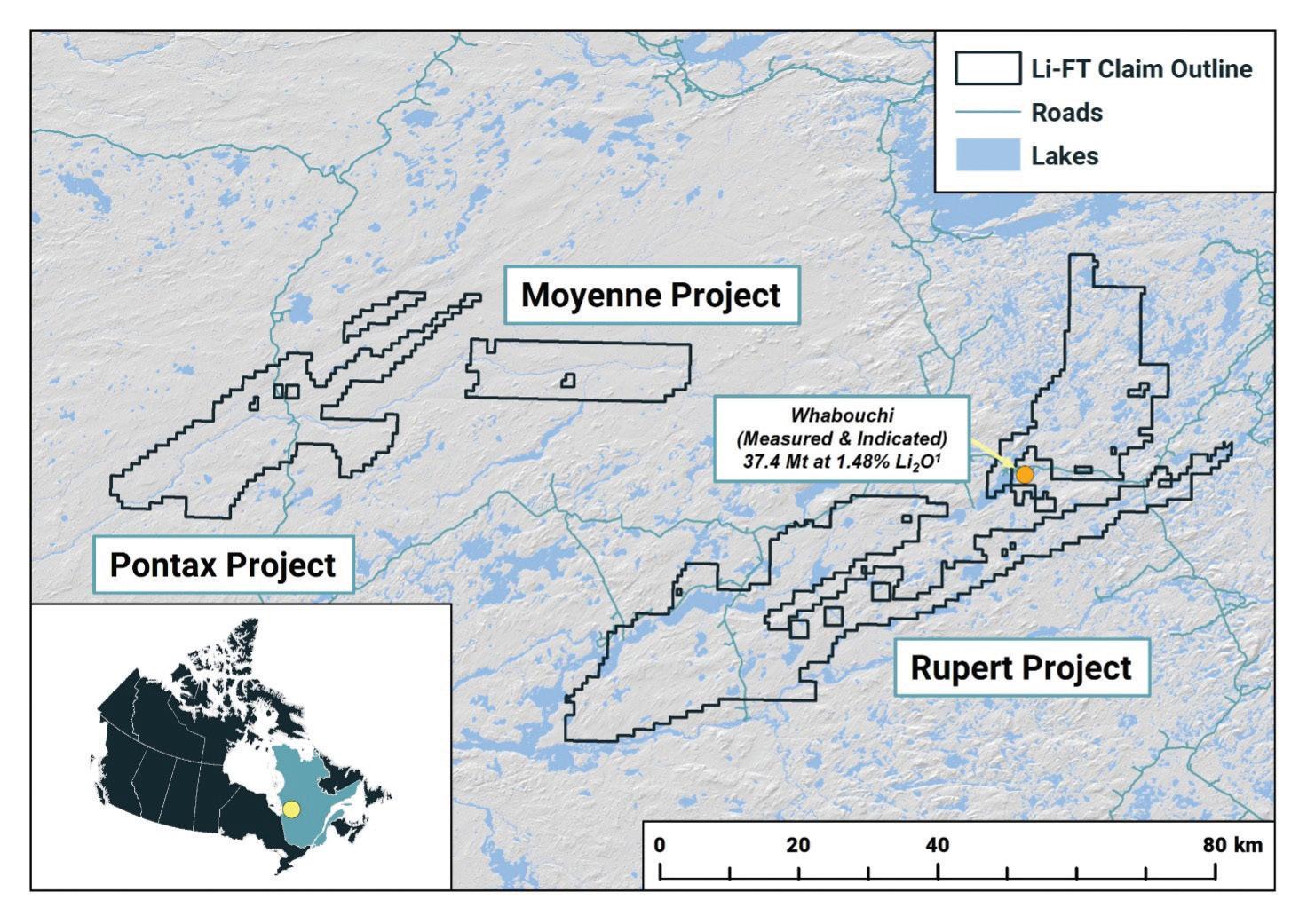

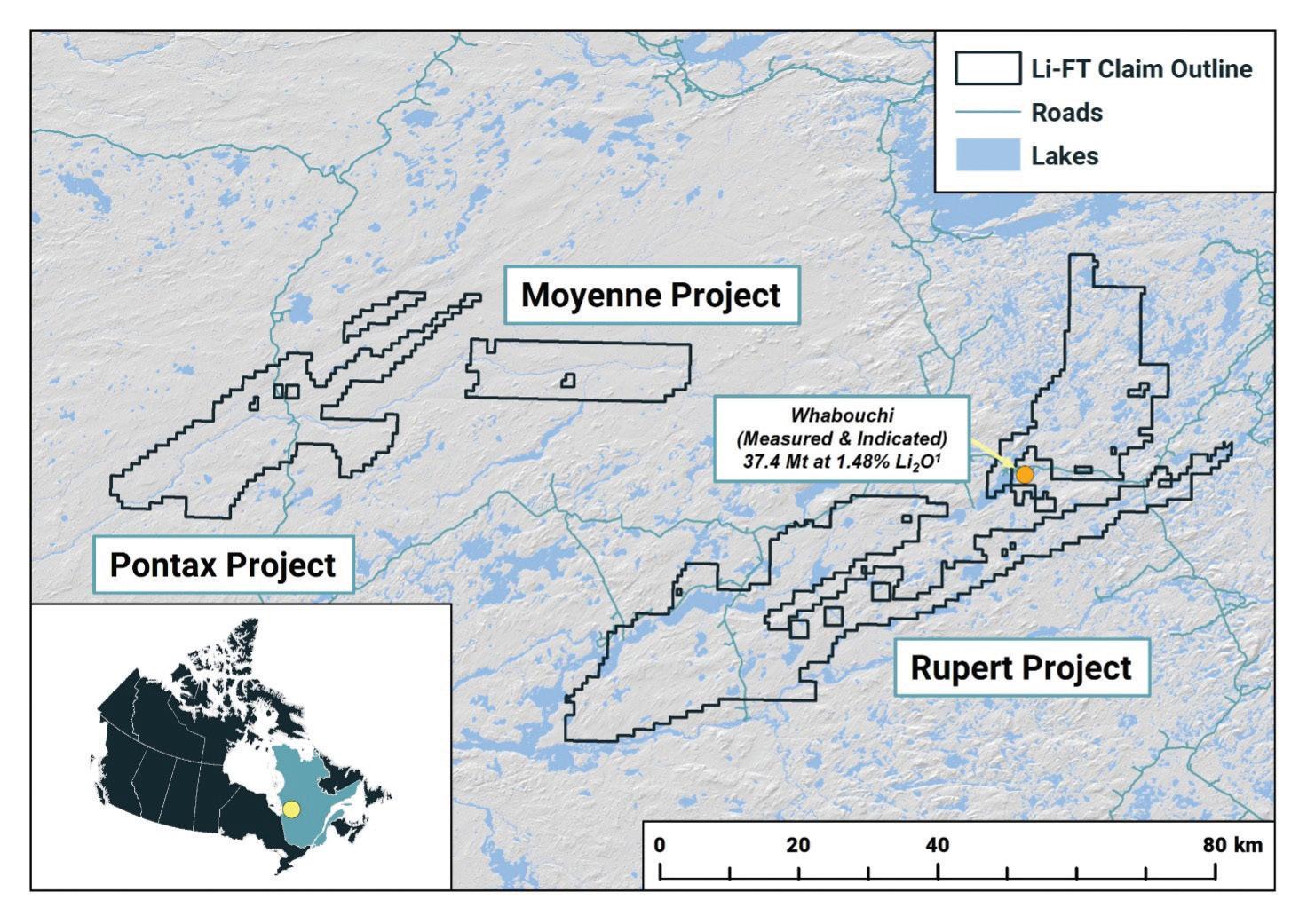

LI-FT POWER

Explorers will race to find lithium over the next decade, and Li-FT intends to lead the field

By Andrew Kessel

Aswath of land lies nestled in the Northwest Territories, not far from the capital city of Yellowknife, where hard rock lithium pegmatites literally stick out of the ground. ey’ve been there for a long time, but few people had reason to take notice.

Now known as the Yellowknife Lithium Project, the site was acquired by Li-FT Power (CSE:LIFT) in November 2022. Covering 14 mineral leases that host numerous spodumene-bearing pegmatite, the area was held privately for 35 years.

Su cient exploration was conducted to demonstrate the world-class lithium resource potential of the dyke systems on the leases. However, the properties lay dormant because lithium had yet to become the vital commodity it is today. at’s about to change.

Li-FT Chief Executive O cer Francis MacDonald believes the lithium market is entering a window of unprecedented potential to generate returns on investment. Lithium-ion batteries are powering a technology revolution that will leave the carbon economy behind. A supply crunch has driven up prices. at has created plenty of jockeying for territory, plus a race to reach production before supply catches up to demand.

“ e world needs more lithium,” MacDonald states plainly. “Lithium is not especially rare; it’s just that the transition to electric mobility supporting the

ght against climate change drastically increased demand for lithium-ion batteries. So, one of the key things now is getting projects into production quickly.”

Li-FT is working with the Indigenous communities in the area to do just that.

e company is currently in the initial permitting and engagement phase, and once that is complete, the intention is to conduct a substantial drill program as soon as possible to con rm the worldclass resource potential is valid.

If things go to plan, drilling under the lithium pegmatites on the surface would deliver enough data to put out an inferred resource estimate a er just one pass, likely in the rst half of 2024.

When the dust settles, this could be one of the largest lithium deposits in North America if what’s visible on the surface goes down to depth at 300 metres, MacDonald says.

e last company to work on the area was Equinox Resources, one of billionaire mining entrepreneur Ross Beaty’s companies. Equinox was acquired in 1993 by Hecla Mining, which was focused on gold exploration, not lithium.

“ is was the early nineties. Lithium was used for ceramics and very special niche markets. No one cared about lithium,” MacDonald explains. “A er the acquisition of Equinox, Hecla didn't have any interest in advancing lithium projects, so they just reverted back to the private company.”

Francis MacDonald Chief Executive Off icer Company

Li-FT Power Ltd.

CSE Symbol LIFT

Listing date

June 27, 2022

Website li-ft.com

COMPANY PROFILE CANADIAN SECURITIES EXCHANGE MAGAZINE JANUARY 2023 | 27

Prior to Li-FT, which named him CEO before making the Yellowknife acquisition, MacDonald spent the earlier part of his career as an exploration geologist with Newmont Mining working in the Canadian Arctic and Africa. In 2016, he co-founded Kenorland Minerals, a North American green eld exploration company.

Most of his previous work was in gold, but in recent years, MacDonald has been drawn to lithium projects. In addition to the metal’s rise in value, lithium projects are quicker to reach the feasibility stage, he says.

For example, a 2 million ounce gold project can require between 500,000 and 1.5 million metres of drilling to reach feasibility. at’s a lot of money and a great deal of time.

Lithium pegmatites, by contrast, need as little as 15,000 metres to reach feasibility, which in turn means a much more attractive return on exploration dollars.

e reason, MacDonald says, is hard rock lithium’s high grade and structural continuity. In other words, you don’t need to drill as much to be con dent about what's beneath the surface.

“ ese pegmatites, they’re cracks that go for two kilometres, and they’re just consistently 20 or 30 metres wide,” he says. “ e structural geometry is a lot more continuous, and the grade is more homogenous as well.”

Other projects just aren’t like that. A vein of quartz, for example, could pinch out and be much shorter than anticipated. To get the same level of con dence requires a lot more drilling.

e value of lithium, the amount a given company is sitting on and the speed with which projects can reach feasibility are going to de ne the sector over the next decade. Li-FT is in a race, and MacDonald likes its chances.

“Everyone's asking for lithium properties now,” he says. “And at some point in the future – 2030, 2035 – supply is going to satisfy or even exceed demand.”

In the meantime, Li-FT is getting its permits in order. at starts with showing the local Indigenous communities that this project will bring economic bene ts to the region.

Communication is key, and MacDonald doesn’t take that lightly.

“ is is traditional land,” he says. “And who am I? I’m a guy from Nova Scotia who lives in Munich saying, ‘I want to drill something in your backyard.’ I always think: if someone came up to my parents in

LITHIUM IS NOT ESPECIALLY RARE; IT’S JUST THAT THE TRANSITION TO ELECTRIC MOBILITY SUPPORTING THE FIGHT AGAINST CLIMATE CHANGE DRASTICALLY INCREASED DEMAND FOR LITHIUM-ION BATTERIES. SO, ONE OF THE KEY THINGS NOW IS GETTING PROJECTS INTO PRODUCTION QUICKLY.

“ 28 | THE MINING ISSUE VRIC EDITION

MACDONALD

Nova Scotia, and they didn’t sit down, have a cup of tea with them and explain what they were proposing, my parents would be pretty annoyed.”

Listening to what has worked, and what hasn’t, with past mining projects helps create a win-win for everyone. Plus, if the experience is positive, that makes the next project easier to get o the ground.

Eventually, if some of the pegmatites go toward a positive feasibility study and eventually into production, that’s when an impact and bene ts agreement could come into play, MacDonald says, helping the a ected First Nations communities.

In addition to Yellowknife, Li-FT controls a combined 228,237 hectares of ground across a trio of green eld lithium pegmatite projects in Québec: Rupert, Pontax and Moyenne. ose projects are prospective for lithium pegmatite too, but it's a totally di erent strategy and will play out over time.

But at Yellowknife, the lithium is actually sticking out of the ground. Someone just needs to take a drill to it and de ne the extent of what is there.

“It’s one of the most interesting exploration opportunities out there right now because it sat in a private company for 35 years for the right group and the right time,” MacDonald concludes. “We just need to show what is below the surface.”

Andrew Kessel covers technology, cannabis and other market sectors for Proactive out of its of ce in New York. He previously worked as a fact-checker for both PolitiFact and Guideposts, covered higher education for the Columbia Missourian and interned at Rolling Stone magazine. Andrew earned his Bachelor of Journalism from the University of Missouri in 2017.

EVERYONE'S ASKING FOR LITHIUM PROPERTIES NOW. AND AT SOME POINT IN THE FUTURE – 2030, 2035 – SUPPLY IS GOING TO SATISFY OR EVEN EXCEED DEMAND.

“ ABOUT THE AUTHOR

MACDONALD

CANADIAN SECURITIES EXCHANGE MAGAZINE JANUARY 2023 | 29

ANNA SERIN SPOTLIGHT ON

CSE’s Director of Listings Development for Western Canada

Anna Serin discusses her views on mining, markets and money in the current economic landscape.

Speaking personally, what fascinates you about the mining industry?

Mining is one of the original sectors. If it’s not grown, it’s mined — pretty much everything we use has an element of mining involved. And the amount of skill, technology, experience and trial and error that goes into the mining process, from exploration to end product, is fascinating.

With a family connection to the mining sector, what’s one thing you want people to know about the industry?

I think the one thing that people should try to wrap their heads around is how long this type of endeavour takes. It’s generational. My great-uncle, Bernard Brynelsen, is in the Canadian Mining Hall of Fame for discovering the Brenda Mines, a famous mine in British Columbia. He experienced a lot of rejection before he was able to

discover something. And that was just the beginning of this mine.

I think in today’s world, there’s a highly prevalent instant gratification mindset, and mining takes time and effort. There are a lot of projects that don’t work, and with such a high chance of failure, I do think it helps to have guidance, often in the form of family in the sector. There’s a passion that gets instilled in you when you come from a mining family that I believe helps keep you going.

You co-host the Weekly Market Recap. Is there something that surprised you the most last year?

Firstly, I always encourage people to take the time to absorb the show because I learn something new every episode. Coming from the broker side, one thing I have learned from doing the show is how much technical analysis my co-hosts, Bruce Campbell and Jordan Youl from StoneCastle Investment Management, do to help provide context on sentiment to investors.

And secondly, we’re truly living in unprecedented times. We can look back on economic cycles with a onedimensional view, but when you’re living in these cycles, you understand how unique they are. There are a lot of external factors affecting the market today: the COVID-19 pandemic, the war in Ukraine, inflation, new asset classes like cryptocurrency. It’s a nonlinear situation for investors, and each episode of the Weekly Market Recap aims to help investors think about how to better position themselves.

What do you feel is the CSE’s most significant contribution to the mining sector?

The mission of the CSE is to lower the cost of capital for public companies. And it is important to understand that enabling a company to easily raise capital at the lowest cost possible is probably the most significant

contribution you can make as an exchange.

A majority of the capital requirements for the mining sector are in exploration, and in this phase, unfortunately, no revenue is generated. The company needs a lot of capital to begin and execute a drill program. It’s not like opening a coffee shop; it’s getting a helicopter out to the middle of nowhere, operating rigs and bringing out a highly skilled team.

A low cost of capital is what helps keep the mining sector running, and once the project goes into production, then it’s generating revenue.

As well, the CSE is a disclosurebased exchange. It’s up to the market to decide the fate of a project, not a small pocket of people. The success of a mining company should be defined by its ability to raise capital and the investors willing to back it.

What are you most excited about in 2023 in the mining sector and beyond?

I’m excited to witness the ongoing shift in investor sentiment toward mining within the next generation of investors. This group gravitates toward investing in cannabis, psychedelics and technology, but they struggle to wrap their heads around mining. If we can get them invested (literally and figuratively) in the mining sector, it’s going to be game-changing.

It’s also very exciting to see developments in mining, from electric-powered mines to battery metals being extracted to power today’s tech. Many people are finally seeing the value of the mining sector. The next generation has the opportunity to decide what mining can mean for them, but they have to get a seat at the table first.

30 | THE MINING ISSUE VRIC EDITION

27 Hours of Mining Over Canada

We took a six-week journey across Canada, exploring the different regions of the country’s mineral-rich terrain and enthralling mining history, from Atlantic Canada to British Columbia. Dig into the full series on CSE TV. It features showcases of companies breaking new ground, panels of industry experts, and discussions on every mining topic you can imagine.

Watch it all on CSE TV now!

YOUTUBE.COM/CSE_TV

Presented by

®

By Peter Murray

By Peter Murray

By Emily Jarvie

By Emily Jarvie